Capital and Investment Strategy: 2024-2029

Published February 2024 An accessible document from southtyneside.gov.uk

Foreword

The Council has a proud record of investment in the borough through consistently delivering a bold and ambitious capital programme which has transformed our schools, housing, leisure and library facilities. Major transport schemes have boosted connectivity and significant investment in our town centres will continue to re-imagine the high street which is less dependent upon traditional retail and more geared towards residential and visitor experience.

Despite the challenges of the pandemic and currently high levels of inflation, we continue to have an impressive long-term programme for re-shaping the borough through our Capital and Investment Strategy which underpins our new strategic plans as set out in our 20-year vision and 5 key ambitions. This is informed by engagement across a range of stakeholders and is linked to our Medium Term Financial Plan (MTFP) providing a framework for future investment whilst setting out our ambitions in sourcing and applying capital resources. This Capital and Investment Strategy is critical to funding and delivering future projects relating to regeneration, transport, housing, digital, supporting our young people and maintaining our core property and vehicle assets. It also continues to provide a focus for local neighbourhood priorities through our Community Area Forums. The Capital and Investment Strategy builds upon our existing commitment expressed in the Council’s Sustainability Strategy to continue to invest in innovative schemes that reduce the borough’s carbon emissions for the long-term.

As resources are limited, we apply a rigorous appraisal to assist in the allocation of funding incorporating an evidence-led approach whilst providing options to ensure that projects align with our strategic ambitions. We continue to successfully leverage external funding where possible to fund our ambitions either individually or through regional partners, public organisations within the borough or attracting commercial investment such as that at the Port of Tyne and the International Advanced Manufacturing Park. In determining the resources available, we ensure that any borrowing which remains a key component of our capital funding is affordable and compliant with the statutory prudential code that debt has to be serviced and repaid and preserving the Council’s financial sustainability over the long-term.

This Capital and Investment Strategy forms a key element of our strategic plans moving forward and helps us in achieving our goal to deliver better outcomes for the borough and our residents.

The Purpose of the Capital and Investment Strategy

This Strategy sets out the long-term context in which capital expenditure and investment decisions are made and gives due consideration to risk, reward and impact on the achievement of priority outcomes. The Strategy sets out how stewardship, value for money, prudence, sustainability and affordability will be secured.

Whilst long-term in focus, South Tyneside Council’s Capital and Investment Strategy will be reviewed on an annual basis, alongside the Medium Term Financial Plan, to reflect the changing needs and priorities of the Council.

The Strategy forms a part of the Council’s integrated revenue, capital and balance sheet planning.

The Council will have regard to the Department of Levelling Up, Housing and Communities (DLUHC) Guidance on Local Government Investments and will comply with The Chartered Institute of Public Finance and Accountancy (CIPFA) Prudential Code of Practice for Capital Finance in Local Authority.

CIPFA issued an updated ‘Prudential Code for Capital Finance in December 2021 which included changes to the capital strategy, prudential indicators and investment reporting implemented from 2023/24.

The key ongoing principle is that an authority must not borrow to invest primarily for financial return. There is a new requirement to report all investments under one of the following headings; service, treasury or commercial.

In accordance with this code, the Council sets prudential limits and indicators which are approved as part of the budget setting process at the start of each financial year. Regular monitoring of these indicators will take place during the year.

The Council’s Capital and Investment Strategy is reviewed and reported annually to Borough Council.

Context

Since 2010 the Council has delivered over £200m of efficiencies, whilst protecting frontline services, through a dramatically redesigned, modern Council. Government funding is expected to fail to keep pace with recent high levels of inflation and growth in service demand across adult and children’s social care which was exacerbated by the Covid-19 pandemic. Consequently, a further £27m of revenue savings are expected to be required over the next 5 years.

Less funding reduces the Council’s ability to fund investment from its own resources. This increases the need to secure alternative sources of external funding - often from a decreasing quantum with increased competition over limited resources.

Regionally, the landscape continues to evolve with the key bodies consisting of The North-East Combined Authority, the North of Tyne Combined Authority, the North-East Local Enterprise Partnership, providing frameworks for joint working and a coordinated approach to changing the economic foundations of the North-East. A new devolution deal covering the seven local authorities of Durham, Gateshead, Newcastle, Northumberland, North Tyneside, South Tyneside and Sunderland has been concluded which will come into effect in 2024 and will unlock significant capital investment and see additional powers transferred to the local area.

South Tyneside Vision

We have ambitious plans to regenerate our towns, homes and communities that will help us to attract investment, create jobs, and improve health and wellbeing outcomes for residents across the borough.

Our 20-year vision is ‘Our South Tyneside, a place where people live healthy, happy and fulfilled lives’. This is our South Tyneside, and we all have an important part to play in making this vision a reality.

We have five ‘Ambitions’ – the key things we want to achieve over the next 20 years to help deliver our vision. These five Ambitions will guide everything we do. We want all people in South Tyneside to be:

Financially Secure

Residents will be financially secure. They will have what they need for a good standard of living.

Healthy and Well

Residents will enjoy good mental and physical health throughout their lives. They will have the best start in life and be able to age well.

Connected to jobs

Residents will have access to jobs, skills, and learning. They will have the skills and confidence to apply for a wide range of quality local jobs. These jobs will be in key and growing areas of employment and benefit all our borough.

Part of strong communities

Residents will live in clean, green, and connected communtieis where they feel safe.

And we want these things for every resident, so we are committed to:

Targeting support to make things fairer

We will target support at the residents and parts of our borough that need it the most, reducing inequalities and making things fairer.

Investment decisions are aligned to these ambitions, ensuring the Council’s plans contribute to the achievement of the overall vision for South Tyneside.

How Capital Spend Decisions are Made

The Capital Investment Programme is developed as part of the annual budget setting process and is considered each February by Borough Council as part of the Medium Term Financial Plan. The Capital and Investment Programme is set for the following five years and reviewed annually.

Members provide direction to assist officers in undertaking preparatory work to provide a range of options on resource allocation. Prioritisation is given to those schemes which relate to preserving the Council’s assets, e.g. roads maintenance and those with a health and safety implication, e.g. bridge and road safety. Taking account of remaining resources, members make spending decisions balancing considerations such as alignment to the five ambitions, pre-existing commitments, residents’ priorities and those schemes which support the Council’s revenue budget by reducing future running costs or increasing future income.

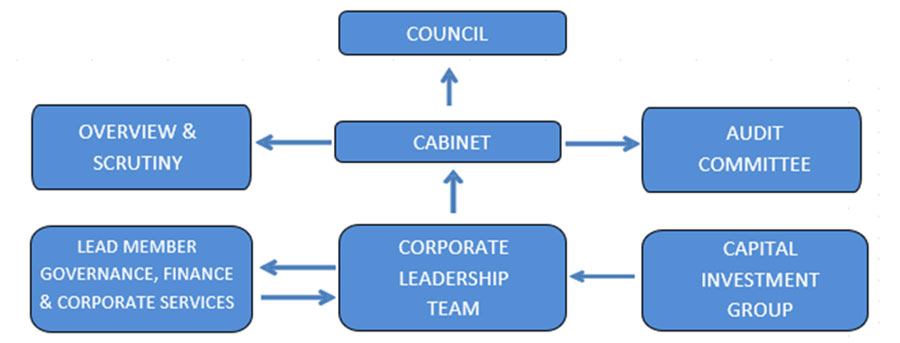

In preparing options for Members consideration, the Capital Investment Group, consisting of senior officers from across the Council and South Tyneside Homes meets monthly. This Group is responsible for the preparatory work associated with the Capital Investment Programme and is chaired by the Director of Business and Resources as the Council’s Chief Financial Officer. The draft programme is reviewed at a strategic level by Corporate Leadership Team taking account of ongoing discussions with Lead Members.

The draft five year rolling programme is considered by the Lead Member for Governance, Finance and Corporate Services after which draft proposals are further considered and debated by Cabinet taking into account funding availability. Final approval is by Borough Council as part of the Medium Term Financial Plan.

Council considers both capital and revenue proposals together, ensuring that any revenue requirements arising from potential capital investment are incorporated into revenue spending proposals. In addition, if insufficient capital resources have been identified, the consequences of potential prudential borrowing and the impact of the related debt charges on revenue can also be considered. This ensures that the Council’s capital investment decisions are affordable, prudent and sustainable in the long-term and that Treasury Management decisions are taken in accordance with good professional practice.

Once the Capital Programme is agreed, Cabinet receive regular updates on financial management via the ‘Quarterly Budget Monitoring Report’ and Treasury Management activity via the ‘Quarterly Treasury Management Report’. The overall system of governance is shown below.

Capital Investment Group

As set out above, the Capital Investment Group is responsible for the preparatory work undertaken to give Members options regarding how the Capital budget could be allocated. The Group is responsible for:

- Coordinating, assessing and initial proposed prioritisation of projects by scoring of projects based on the following criteria:

- Alignment with strategic priorities

- Positive impact for residents

- Meeting statutory requirements

- Deliverability (including leverage of external funding)

- Promoting a cross-cutting approach ensuring all service areas are sighted on potential impact of proposals;

- Overseeing, co-ordinating and supporting external funding opportunities;

- Monitoring the progress of spend across the capital programme throughout the year including the transfer of funding between schemes;

- Reviewing proposals to transfer funds across financial years for consideration by Cabinet.

To ensure proposals from all services are considered, the Capital Investment Group requires for each scheme a ‘Capital Investment – Outline Business Case’. The Outline Business Case includes a detailed project description and an identified project manager. Proposed schemes reflect ongoing discussions with Cabinet Members on priorities and can include various options for debate around the details of major infrastructure schemes.

The aim of any capital project should be to help achieve one or more of the Council’s five ambitions. The ‘Measurable Success Criteria’ section allows the scheme promoter to demonstrate how the proposed project links to the Council’s Strategic Plan and details what measurable outcomes would be achieved from the investment.

To assist the Capital Investment Group in undertaking an initial appraisal of capital proposals, the Outline Business Case requests details of ‘Key Milestones’. Capital projects can face delays often due to their complexity or factors out of the Council’s control, e.g. weather or procurement issues. The inclusion of key milestones within the Outline Business Case assists in the evaluation of deliverability, the profile of funding allocations and supports subsequent monitoring.

A ‘Risk Assessment’ is included as part of the proposal where potential risks associated with the delivery of the scheme, e.g. cost overruns, timings and the failure to meet the set objectives are considered. This also allows the risks associated of not progressing with the scheme to be evaluated, such as asset failure, or failing to maintain health and safety requirements.

The ‘Cost’ and ‘Funding’ section comprises the total gross cost of the project, the amount of external funding that the project will or is expected to attract and the source of that funding. The balance is the call on Council funding which is being requested. The accuracy and realism of costings and timescales are challenged by the Group.

The final section of the Outline Business Case is ‘Net Revenue Implications’ which provides the scheme promoter an opportunity to highlight any revenue savings or costs which may arise as a result of the capital project, e.g. reductions in utilities costs and building maintenance or alternatively additional staffing and maintenance which may be required to be built into the revenue budget.

The robust process followed in shaping the Outline Business Case for each scheme ensures sufficient information is available, allowing the Capital Investment Group to make sound judgements on scheme viability for further consideration by Members.

Monitoring and Project Management of the Capital Programme

Cabinet retains strategic oversight of the delivery of the capital programme. Regular reports on design and procurement options, locations and timescales are debated and considered by Lead Members in respect of major projects.

The Capital Investment Group categorises Capital projects as High, Medium or Low risk based on their complexity, the likelihood of slippage/acceleration or potential to under/overspend, which informs the level of monitoring and scrutiny. Gross spend is monitored against project budgets which are adjusted whenever additional external funding is secured or anticipated funding reduced. Budget holders update details of their schemes with forecasts of spend and income for the year as well as forecasting any slippage and intentions for budgets to be considered for carry forward into the following financial year.

Finance officers meet with scheme budget holders on a frequency dictated by the associated risk rating and challenge the forecasts provided in the monitoring reports on levels and timing of spend. This allows the Council to more effectively manage its cash flow requirements, minimising debt servicing costs.

Applying the monitoring information, the Council’s Capital Financing Requirement (CFR) can be calculated to establish how much borrowing is required as a result of spend. This enables a forecast revenue cost for debt servicing to be included in the revenue section of the monthly finance report, showing the linkages between capital and revenue expenditure.

The resulting forecasts from the monitoring process are collated into an appendix for the periodic finance reports which are presented to Corporate Leadership Team and Cabinet for consideration, with the capital element also reported to Capital Investment Group.

The financial performance of capital projects is reported regularly to Capital Investment Group.

Funding the Capital Programme

Grant Funding / External Contributions

The Council has a structured and co-ordinated approach to the pursuit of external funding to ensure alignment with objectives, sustainability of match funding and the avoidance of duplication. Key sources of external funding are received from central government departments, as well as from government agencies, The North-East Mayoral Combined Authority, the North-East Local Enterprise Partnership and from private developers, among others. These are used to support investment in assets, as well as regeneration activities. The Council seeks to maximise grant funding wherever possible. Key capital funding streams which the Council are seeking to access include:

- North-East Mayoral Combined Authority/ North-East Local Enterprise Partnership

- Levelling Up Fund (South Tyneside Borough) to support regeneration, town centre improvements, transport and culture projects

- Towns Fund to drive economic and productivity growth

A small number of grants are ring-fenced for expenditure in specific services, e.g. Devolved Formula Capital, which is allocated to schools. The majority of grant funding is not ring-fenced. These grants which are not ring-fenced are allocated to assets with the shortest lifespan to ensure that long-term borrowing is prudently applied against assets with longer lifespans.

Grant funding is an important income stream for the Council’s Capital Programme, particularly with regards to major transport and economic regeneration schemes.

Developer contributions

Contributions from landowners under Section 106 agreements towards services and infrastructure as part of granting planning permission will be applied where the investment satisfies the conditions of the agreement. An update on S106 agreements is presented quarterly at the Capital Investment Group by the Senior Manager Planning.

Borrowing

Under part 1 of the Local Government Act 2003 authorities are required by regulation to have regard to the Prudential Code when carrying out their duties. The objectives of the Prudential Code are to ensure that the capital expenditure plans of local authorities are affordable, prudent and sustainable. The Council’s strategy is to maximise grant funding and capital receipts before applying borrowing as a source of funding for the capital programme.

When borrowing is required the level of affordability is assessed against the available debt charges revenue budget as part of the Medium Term Financial Planning process. It is the statutory responsibility of the Section 151 Officer to establish the level of borrowing that is deemed affordable and to sign off this determination. In order to manage that borrowing activity, the Council produces an annual Treasury Management Strategy which is approved and adopted by Borough Council and includes both the plan for the Consolidated Loans Fund and the Investment Strategy.

The Council recognises the implications that capital expenditure has upon the revenue budget and is reflected in the long-term planning process. This impact is two-fold. Firstly, the increase in the Minimum Revenue Provision charge which needs to be set aside from revenue to provide for the cost of each capital project funded through borrowing and secondly is the interest that is charged against that borrowing.

These linkages demonstrate why it is necessary to develop the capital and revenue budgets, the Capital and Investment Strategy and the Treasury Management Strategy together to ensure that the requirements of the Prudential Code – affordability, prudence and sustainability are met.

The Council is generally utilising available cash balances to finance capital expenditure where appropriate rather than taking on external debt. However, this is balanced with selective borrowing when long-term interest rates fall to low levels which can provide significant cost savings over many years. This funding strategy is reviewed continuously in order to respond flexibly to changes in market trends and volatility.

As detailed in the Treasury Management Strategy, the Council prioritises security of its investments over yield. This risk management approach requires thorough due diligence to be undertaken when investing the Council’s funds. As well as using a weighted scoring system to assess creditworthiness of counterparties supported by external advisers, the Council applies its own due diligence by using market data, information on Government support for banks and the likelihood of Government support to determine the most secure places to invest funds. Further detail on this approach can be found in the Treasure Management Strategy at Appendix 6.

Capital Receipts

Capital receipts are generated from the sale of assets exceeding £10,000. Disposals below that value are classified as revenue income. Capital receipts are used to support the Council’s capital programme and help to minimise the need for prudential borrowing. The Council’s Asset Management team identify assets which are surplus to requirements and an option appraisal is carried out to support decision making by Members. If it is concluded that a sale is the most appropriate option, the asset can be sold to generate a funding stream for new capital investment.

Asset disposals need to be structured, if they are to be relied upon as a funding source and the Council takes a long-term approach to asset disposal. This provides a more consistent funding stream since by their nature these receipts are irregular and finite.

Each asset will be subject to detailed option appraisal for consideration by Cabinet. Options include retention, open market sale, direct development through Centaurea Homes, or development of extra care schemes for the elderly, joint ventures, etc.

Revenue Funding

Another source of funding for the capital programme is to apply revenue budgets contribute to capital projects. The Council prefers to limit this source of funding due to the on-going pressures on the revenue budget at present although it can be more applicable to assets with short useful lives.

Prudential Indicators

Local authorities are obliged to consider prudential indicators to reflect local circumstances. It is the objective of the Council that debt costs as a proportion of the net revenue budget be broadly static, except where such additional costs are covered by a related income stream. The following table sets out the forecast position for the following 3 years for net financing costs to net revenue stream, and internal borrowing to underlying borrowing. The Council does not anticipate any income from non-treasury investments.

| Prudence measures | (revised) 2023/24 | 2024/25 | 2025/26 | 2026/27 | 2027/28 | 2028/29 |

|---|---|---|---|---|---|---|

| % | % | % | % | % | % | |

| Rate of Financing Costs to Net Revenue Stream (Council) | 12.36% | 13.24% | 13.30% | 13.53% | 13.56% | 13.28% |

| Ratio of Internal Borrowing to Underlying Borrowing | 9.85% | 9.85% | 9.88% | 9.96% | 10.07% | 10.21% |

Commerical Activity - Investment Strategy

This Investment Strategy is prepared to comply with statutory guidance issued by the DLUHC.

The DLUHC and CIPFA have extended the meaning of ‘investments’ to include both financial and non-financial investments. The revised Prudential Code requires all investments and investment income to be attributed to one of the following three purposes:

- Treasury Management

- Arising from the Council’s cash flows or treasury risk management activity, this type of investment represents balances which are only held until the cash is required for use. Treasury investments may also arise from other treasury risk management activity which seeks to prudently manage the risks, costs or income relating to existing or forecast debt or treasury investments.

- Service delivery

- Investments held primarily and directly for the delivery of public services including housing, regeneration and local infrastructure. Returns on this category of investment which are funded by borrowing are permitted only in cases where the income is “either related to the financial viability of the project in question or otherwise incidental to the primary purpose”.

- Commercial return

- Investments held primarily for financial return with no Treasury Management or direct service provision purpose. Risks on such investments should be proportionate to an authority’s financial capacity – i.e. that ‘plausible losses’ could be absorbed in budgets or reserves without unmanageable detriment to local services. An authority must not borrow to invest primarily for financial return.

Treasury Management

The Treasury Management Strategy deals with Treasury (financial) investments, which are regarded as part of the ‘core’ Treasury Management activity, i.e. the investment of surplus cash flow balances.

Non-Treasury Investment Principles

Investment decisions will be made with the primary purpose of supporting the regeneration and economic resilience of the borough.

In accordance with the Prudential code the Council will not borrow to invest in commercial investments primarily for financial return.

The risks associated with service and commercial investments would be considered and be appropriate to their financial capacity i.e. that plausible losses could be absorbed in budgets or reserves without unmanageable detriment to local services.

The Council will not make any investment or spending decisions that will increase the CFR leading to new borrowing unless directly and primarily related to the functions of the authority, and where any commercial returns are either related to the financial viability of the project in question otherwise incidental to the primary purpose.

A robust financial case would be considered for any new investment proposal.

The approval of any new proposal would follow existing governance and approval processes as set out in the Council’s constitution.

A new prudential indicator is required to show the net income from commercial and service investments as a proportion of the net revenue stream.

Commerical Investments

Where commercial opportunities arise, an assessment of capital investment requirements will be undertaken as part of any business case appraisal. Such investments could be in the areas of commercial property, loan financing, fleet, digital and ICT, etc. The theme of commercialism forms part of the Year 2 Our Council Change Programme.

Independent, expert legal advice and scrutiny arrangements will be included alongside any business case proposals for new investments.

The Government introduced new rules preventing Council’s borrowing from the PWLB where it is intended to fund an investment primarily expected to generate a return. The Council has no such borrowings nor has any plans for such borrowings and therefore will be compliant with the new rules.

Increased national regulation on commercial activity is reflected in the revised Treasury Management Code which sets out the following Management Practices and requirements for non-financial investments which the Council observe namely:

- South Tyneside Council will ensure that all the organisation’s investments are covered in the capital strategy, investment strategy or equivalent, and will set out, where relevant, the organisation’s risk appetite and specific policies and arrangements for non-treasury investments. It will be recognised that the risk appetite for these activities may differ from that for Treasury Management.

- South Tyneside Council will maintain a schedule setting out a summary of existing material investments, subsidiaries, joint ventures and liabilities including financial guarantees and the organisation’s risk exposure.

Service Delivery Investments

The Council's current investments are all held primarily and directly for the delivery of public services including housing, regeneration and local infrastructure rather than for income generation.

Loans to External Bodies and Organisations

The Council has wide powers to provide loan funding to other bodies to support its wider economic and regeneration objectives. For example, the Council has provided a loan facility agreement from March 2014 to South Tyneside Housing Ventures Trust Limited. This facility enabled Housing Ventures to borrow £40m from the Council for the purposes of increasing the supply of affordable homes with over 400 units delivered. This loan facility, along with the properties, has now transferred across to Karbon Homes. Any lending is secured on the value of the assets to protect the Council’s financial interests.

The principal element of the loan repayment to the Council is matched to the amount of MRP charged to revenue, thus creating zero impact on the revenue budget. The interest element of the loan repayment is credited to revenue at a slightly higher rate than PWLB borrowing rates generating a small income stream.

Centaurea Homes Limited is a Council-owned housing development company. The Council can provide a loan facility which will generate an income stream secured against the properties constructed. Additional sites in the borough may be developed dependent upon viability and market conditions.

Environmental Sustainability

The Council has an ambitious Sustainability South Tyneside Strategy 2020-2025 that can be found on the Council website that is moving us towards Net Zero by 2030, delivering pioneering renewable energy projects.

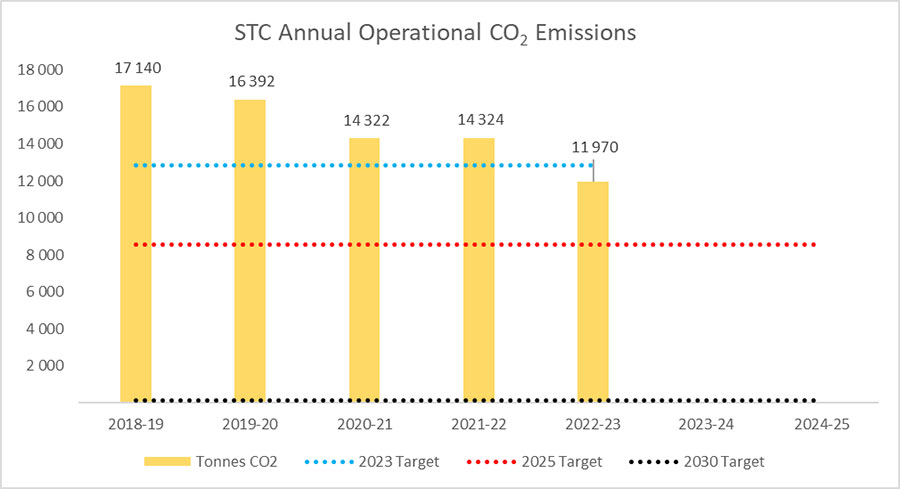

A 5-year action plan was developed to support the delivery of the emissions reduction target:

- 25% reduction within 3 years (March 2023)

- 50% reduction within 5 year (March 2025)

The Council has achieved its first interim target of a 25% emissions reduction by March 2023, as illustrated below, which shows that to date there has been a reduction of 5,170 tonnes against the baseline which equates to a 30% emissions reduction overall.

The Council will support green and sustainable choices and behaviours and connections to the natural environment, including setting an example as an organisation with electric and hybrid fleet vehicles, planting more trees across the Borough and leading the way nationally around coastal recovery.

Many of the Council’s Capital investments will help the Council achieve their goal such as:

- Holborn Renewable Energy Network, Viking Energy Network and Hebburn Renewable Energy Scheme - Projects that will utilise renewable technologies to create innovative energy networks providing heat and electricity to a number of buildings. The schemes are expected to cut carbon emissions and produce savings on fuel costs which will assist the Council’s pledge to be Carbon Neutral by 2030.

The successful delivery of these schemes will see a potential 50% reduction against the baseline position of 3,400 tonnes reduction by 2025 to meet the 50% reduction target. - Stronger Shores - This project is 100% funded through Environment Agency Flood Defence Grant and Aid. The project aims to improve understanding of the costs and benefits of kelp, seagrass and native habitats with regards to coastal erosion, flood risk, climate change, biodiversity management, water quality and wider social benefits.

- LED Lighting - We continue to improve the energy efficiency of the Borough. As of the end of 2023, 87% of adopted street lighting columns are now LED, with full conversion expected by 2026/7. We have removed 3,107 tonnes of CO2 per annum through street light upgrades,and saved £1.3m per year in energy costs.

- Active Travel - We are supporting awareness and behavioural change around climate change promoting a shift towards sustainable and active modes of transport. This includes adoption of an agile working policy reducing private car journeys. We are also investing in greater electrification of our own fleet-details and have 20 electric vehicles and 59 operational charging units across the Borough.

- A new ‘green gym’ was launched over summer 2023 as part of a £700k refurbishment of Monkton Stadium. The exercise machines capture energy generated from users and converts it into electricity.

- A significant buildingrationalisation programme has seen old and inefficient buildings replaced with centralised hubs installed with improved LED lighting, building management systems, in addition to renewable and energy efficient technologies. Examples include:

- Installation of Solar PVs to 21 Council buildings;

- Combined heat and power units installed at Haven Point, Hebburn Central, Boldon Community Association and Horsley Hill Childrens centre.

- Remodelling of Temple Park leisure centre including new boiler plant, heat pumps, LED lighting and building management system.

- Monkton Stadium improvements including LED lighting upgrades and boiler replacements.

- New Network for Electric Vehicle Charging - South Tyneside Council has entered a partnership with Connected Kerb, one of the UK's leading electric vehicle charging infrastructure providers, to deliver the largest ever electric vehicle charger rollout in the North of England, with up to 2,000 new charge points to be installed across the Borough.

Capital Risks

Risks that may impact the Capital and Investment Strategy must be managed and communicated so that appropriate adjustments can be made to mitigate impact. Some of the key risks are detailed below:

- Cost Inflation - Inflation is currently running at around 4% which can impact on construction, materials, employment and build costs. This is mitigated by the regular review and monitoring of projects against budgets to identify pressures and the development of a business case to release capital funding from elsewhere within the capital programme if required.

- Capital Receipts - The generation of capital receipts is monitored on a regular basis to ensure there is no shortfall in funding of the capital programme. Future capital receipts are also considered so that sources of alternative funding can be sourced or that reductions are made to future years’ capital programmes in order to maintain affordability.

- Interest Rate Increases - A prudent rate of interest is assumed at the time when the programme affordability is calculated to determine the likely borrowing costs of the capital programme. The rates considered are forecasts from Link Group (The Councils Treasury Adviser) and Capital Economics (an independent forecasting consultancy).

- Government Funding - Prudent assumptions are made on grant funding when setting the capital programme. Any reductions that cannot be met from other sources would result in adjustments to the capital programme when it is reviewed.

- Not managing spend within budgets - To mitigate this risk there is regular capital monitoring reviewing each project against agreed budgets. The Capital position is reported to the Capital Investment Group and to Cabinet quarterly.

- Insufficient tenders received to ensure value for money - Market engagement in advance to obtain expressions of interest and exploring the ability to amend the Cabinet approval process by increasing current limits to reduce the tender timeframe could help mitigate risk in this area.

Knowledge and Skills

The Council has a number of professionally qualified legal, finance and property officers to support the delivery of the Treasury Management Strategy and the Capital and Investment Strategy.

These officers regularly attend training courses, seminars and conferences to ensure they are kept up to date with regulatory practices and best practice.

Bi-monthly project board meetings take place with Senior Regeneration Management, programme managers and finance representatives.

The Council uses Link Group as its external Treasury Management advisers to access specialist skills and resources.

The Council would consult specialist advisers before undertaking any non-treasury investments.

The Council has incorporated Treasury and Capital training as part of the Members’ Development programme.

The 2024-29 Capital Programme

The framework established by the Capital and Investment Strategy supports the formulation of the Council’s Capital Investment Programme. The provisional five-year Capital Programme for 2024-29 is detailed below:

| 2024/25 | 2025/26 | 2026/27 | 2027/28 | 2028/29 | Total | |

|---|---|---|---|---|---|---|

| Gross (£m) | Gross (£m) | Gross (£m) | Gross (£m) | Gross (£m) | Gross (£m) | |

| Healthy and Well | ||||||

| Playing Field and Facility Improvements | 0.500 | 0.500 | 0.500 | 0.500 | 0.500 | 2.500 |

| Playground Equipment | 0.150 | 0.150 | 0.150 | 0.150 | 0.150 | 0.750 |

| Gateway Roundabouts | 0.060 | 0.060 | - | - | - | 0.120 |

| Allotment Fencing | 0.060 | 0.060 | 0.060 | 0.060 | - | 0.240 |

| Playground safety gates | 0.050 | 0.050 | 0.050 | - | - | 0.150 |

| Devolved Formula Capital | 0.333 | 0.333 | 0.333 | 0.333 | 0.333 | 1.665 |

| Mortimer | 3.100 | - | - | - | - | 3.100 |

| Coast Road Active Travel | 2.000 | - | - | - | - | 2.000 |

| Total Healthy and Well | 6.253 | 1.153 | 1.093 | 1.043 | 0.983 | 10.525 |

| Part of Strong Communities | ||||||

| School/Pedestrian Safety | 0.300 | 0.300 | 0.300 | 0.300 | 0.300 | 1.500 | `

| Demolitions | 0.300 | 0.300 | 0.300 | 0.300 | 0.300 | 1.500 | `

| Fleet Vehicle Replacement Programme | 1.500 | 1.500 | 1.500 | 1.500 | 1.500 | 7.500 |

| Wheeled new bins | 0.155 | 0.155 | 0.155 | 0.155 | 0.155 | 0.775 |

| Asset Transfer | 0.200 | 0.200 | 0.200 | - | - | 0.600 |

| Securing vacant buildings | 0.100 | 0.100 | 0.100 | 0.100 | 0.100 | 0.500 |

| Chuter Ede demolition | 0.400 | - | - | - | - | 0.400 |

| Holborn Riverside development | 6.480 | 5.280 | 8.280 | 5.280 | 0.080 | 25.400 |

| Litter and recycling | 0.250 | 0.250 | 0.250 | 0.250 | 0.250 | 1.250 |

| Untidy site improvement | 0.710 | 1.000 | 1.000 | - | - | 2.710 |

| Street Lighting LED | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 5.000 |

| Hebburn Regeneration | 0.175 | - | - | - | 0.075 | 0.250 |

| Holborn Energy (WHREN) | 17.700 | - | - | - | - | 17.700 |

| Flood and Coastal Medium Term Programme | 0.103 | 0.354 | 0.213 | 0.857 | 0.200 | 1.727 |

| Riverside Structures | 0.100 | 0.100 | 0.100 | 0.100 | 0.100 | 0.500 |

| Decarbonising Transport (ultra low emissions) | 0.100 | 0.100 | 0.100 | 0.100 | 0.100 | 0.500 |

| Laygate - public realm improvements | 0.100 | - | - | - | - | 0.100 |

| Stronger Shores | 1.034 | 1.234 | 1.234 | 0.034 | 0.034 | 3.570 |

| Greenspace projects | 0.080 | 0.080 | 0.080 | 0.080 | 0.080 | 0.400 |

| Industrial units | 0.500 | 0.500 | - | - | - | 1.000 |

| Vinyl Flooring the WORD | 0.400 | - | - | - | - | 0.400 |

| Residential Development (Young People) | 0.350 | - | - | - | - | 0.350 |

| Customs House | 5.300 | - | - | - | - | 5.300 |

| Decent Homes (Housing) | 22.118 | 21.604 | 22.100 | 22.519 | 23.391 | 111.731 |

| Public sector Housing Other | 5.187 | 5.685 | 5.177 | 4.749 | 3.872 | 24.671 |

| Programme Fees (Housing) | 1.243 | 1.243 | 1.243 | 1.243 | 1.243 | 6.214 |

| Disabled Adaptations (Housing) | 0.900 | 0.900 | 0.900 | 0.900 | 0.900 | 4.500 |

| Total Part of Strong Communities | 66.785 | 41.960 | 44.232 | 39.467 | 33.605 | 226.048 |

| Connected to Jobs | ||||||

| Strategic Transport Feasibility Studies | 0.125 | 0.125 | 0.125 | 0.125 | 0.125 | 0.625 |

| DICT | 2.200 | 2.200 | 2.200 | 2.200 | 2.200 | 11.000 |

| South Shields Town Centre | 10.800 | 7.200 | - | - | - | 18.000 |

| Middlefields External Works Masterplan | 3.700 | 2.700 | - | - | - | 6.400 |

| Road Resurfacing Programme | 2.000 | 2.000 | 2.000 | 2.000 | 2.000 | 10.000 |

| IAMP | 11.249 | 2.000 | - | - | 0.000 | 13.249 |

| Local Transport Plan funding | 2.561 | 2.561 | 2.561 | 2.561 | 2.561 | 12.805 |

| Concrete Bay Replacement | 0.300 | 0.300 | 0.300 | 0.300 | 0.300 | 1.500 |

| Car Parking Maintenance | 0.200 | 0.200 | - | - | - | 0.400 |

| Total Connected to Jobs | 33.135 | 19.286 | 7.186 | 7.186 | 7.186 | 73.979 |

| Targeting Support | ||||||

| CAF Environmental | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 5.000 |

| Disabled Facilities Grants | 1.918 | 1.918 | 1.918 | 1.918 | 1.918 | 9.590 |

| Total Targeting Support | 2.918 | 2.918 | 2.918 | 2.918 | 2.918 | 14.590 |

| Other | ||||||

| Oracle Replacement | 5.000 | 5.000 | - | - | - | 10.000 |

| Mobile CCTV | 0.050 | - | - | - | - | 0.050 |

| Contingency | 0.070 | 0.070 | 0.070 | 0.070 | 0.070 | 0.350 |

| Asset Maintenance | 2.600 | 2.600 | 2.600 | 2.600 | 2.600 | 13.000 |

| Total Other | 7.720 | 7.670 | 2.670 | 2.670 | 2.670 | 23.400 |

| Total | 116.811 | 72.987 | 58.099 | 53.284 | 47.362 | 348.542 |

Funding of the Capital Programme 2024-29

| Capital Programme By Funding | 2024/25 | 2025/26 | 2026/27 | 2027/28 | 2028/29 | Total |

|---|---|---|---|---|---|---|

| £m | £m | £m | £m | £m | £m | |

| Council General Fund Programme | ||||||

| External Funding | 64.126 | 21.528 | 13.892 | 11.016 | 7.664 | 118.226 |

| Capital Receipts | 2.000 | 2.000 | 2.000 | 2.000 | 2.000 | 10.000 |

| Revenue Contribution to Capital | 3.500 | 3.500 | 1.000 | 1.000 | 1.000 | 10.000 |

| Borrowing | 17.737 | 16.527 | 11.787 | 9.857 | 7.292 | 63.200 |

| Total Council General Fund Programme | 87.363 | 43.555 | 28.679 | 23.873 | 17.956 | 201.426 |

| Housing Programme (funded from the Housing Revenue Account) | ||||||

| Revenue Funding of Housing Capital programme | 29.448 | 29.432 | 29.420 | 29.411 | 29.406 | 147.116 |

| Total Housing Programme | 29.448 | 29.432 | 29.420 | 29.411 | 29.406 | 147.116 |

| Combined Housing and General Fund Programme | 116.811 | 72.987 | 58.099 | 53.284 | 47.362 | 348.542 |

A breakdown of the Capital Programme for 2024/25 is included below:

| Budget £m | External Funding £m | Council Funding £m | ||||

|---|---|---|---|---|---|---|

| Healthy and Well | ||||||

| Mortimer School Expansion | 3.100 | 2.400 | 0.700 | |||

| Coast Road Active Travel | 2.000 | 1.600 | 0.400 | |||

| Play field and facility improvements | 0.500 | - | 0.500 | |||

| Devolved Formula Capital | 0.333 | 0.333 | 0.000 | |||

| Playground equipment | 0.150 | - | 0.150 | |||

| Gateway roundabouts | 0.060 | - | 0.060 | |||

| Allotment fencing | 0.060 | - | 0.060 | |||

| Playground safety gates | 0.050 | - | 0.050 | |||

| Total Healthy and Well | 6.253 | 4.333 | 1.920 | |||

| Part of Strong Communities | ||||||

| Decent Homes (Housing) | 22.118 | - | 22.118 | |||

| Holborn Energy (WHREN) | 17.700 | 17.700 | 0.000 | |||

| Holborn Riverside Development | 6.480 | 6.480 | 0.000 | |||

| Customs House | 5.300 | 5.300 | 0.000 | |||

| Public Sector Housing Other | 5.187 | - | 5.187 | |||

| Fleet Vehicle Replacement Programme | 1.500 | - | 1.500 | |||

| Programme Fees (Housing) | 1.243 | - | 1.243 | |||

| Stronger Shores | 1.034 | 1.000 | 0.034 | |||

| Street Lighting LED | 1.000 | - | 1.000 | |||

| Disabled Adaptations (Housing) | 0.900 | - | 0.900 | |||

| Untidy site improvement | 0.710 | - | 0.710 | |||

| Industrial units | 0.500 | - | 0.500 | |||

| Chuter Ede demolition | 0.400 | - | 0.400 | |||

| Vinyl Flooring the WORD | 0.400 | - | 0.400 | |||

| Residential Development (Young People) | 0.350 | - | 0.350 | |||

| School/Pedestrian Safety | 0.300 | 0.050 | 0.250 | |||

| Demolitions | 0.300 | - | 0.300 | |||

| Litter and recycling | 0.250 | - | 0.250 | |||

| Asset Transfer | 0.200 | - | 0.200 | |||

| Hebburn Regeneration | 0.175 | - | 0.175 | |||

| Wheeled new bins | 0.155 | - | 0.155 | |||

| Flood and Coastal Medium Term Programme | 0.103 | 0.053 | 0.050 | |||

| Securing vacant buildings | 0.100 | - | 0.100 | |||

| Riverside Structures | 0.100 | - | 0.100 | |||

| Decarbonising Transport (ultra low emissions) | 0.100 | 0.025 | 0.075 | |||

| Laygate - public realm improvements | 0.100 | - | 0.100 | |||

| Greenspace projects | 0.080 | - | 0.080 | |||

| Total Part of Strong Communities | 66.785 | 30.608 | 36.177 | |||

| Connected to Jobs | ||||||

| IAMP | 11.249 | 11.249 | 0.000 | |||

| South Shields Town Centre | 10.800 | 10.800 | 0.000 | |||

| Middlefields External Works Masterplan | 3.700 | - | 3.700 | |||

| Local Transport Plan funding | 2.561 | 2.561 | 0.000 | |||

| DICT | 2.200 | - | 2.200 | |||

| Road Resurfacing Programme | 2.000 | 1.000 | 1.000 | |||

| Concrete bay replacement | 0.300 | - | 0.300 | |||

| Car parking maintenance | 0.200 | - | 0.200 | |||

| Strategic Transport feasibility studies | 0.125 | 0.025 | 0.100 | |||

| Total Connected to Jobs | 33.135 | 25.635 | 7.500 | |||

| Targeting Support | ||||||

| Disabled Facilities Grants | 1.918 | 1.918 | 0.000 | |||

| CAF Environmental | 1.000 | 0.000 | 1.000 | |||

| Total Targeting Support | 2.918 | 1.918 | 1.000 | |||

| Other | ||||||

| Asset Maintenance | 2.600 | 1.632 | 0.968 | |||

| Oracle Replacement | 5.000 | - | 5.000 | |||

| Contingency | 0.070 | - | 0.070 | |||

| Mobile CCTV | 0.050 | - | 0.050 | |||

| Total Other | 7.720 | 1.632 | 6.088 | |||

| Total | 116.811 | 64.126 | 52.685 | |||

A detailed is of the forecast external funding for 2024-25 is included below:

| External Capital Funding Forecast | 2024/25 £m |

|---|---|

| Capital Grant from Government and other Agencies | |

| LEP - Enterprize Zone Business Rate Growth Income | 17.729 |

| Green Heat Network Fund | 6.000 |

| Department for Transport | 5.186 |

| Environment Agency | 1.053 |

| Disabled Facilities Grant | 1.918 |

| Office for low emissions | 0.075 |

| DfE School Condition Grant | 1.632 |

| Supported Borrowing - WHREN | 5.000 |

| Devolved Formula Capital | 0.333 |

| Department for Levelling Up | 22.800 |

| Basic Needs | 2.400 |

| Council Capital Programme | 64.126 |

| External Funding Secured and Provisional | |

| External Funding Secured | 25.322 |

| External Funding Probable | 32.804 |

| External Funding Possible | 6.000 |

| Total External Capital Funding Forecast | 64.126 |

Long Term Planning

The Prudential code requires the Capital and Investment Strategy to consider the longer-term capital investment requirements whilst acknowledging they will involve a high level of estimation.

The table below estimates high level capital investments over a further 20-year period of recurring projects in the capital programme. These are indicative figures and are subject to change.

| Estimate 2024-29 £m | Estimate 2030-44 £m | |

|---|---|---|

| Road resurfacing | 10.000 | 30.000 |

| Asset Maintenance | 5.000 | 15.000 |

| Fleet | 6.750 | 20.250 |

| ICT | 11.000 | 30.000 |

- Road resurfacing

- An ongoing project to fund a 10-year recovery plan to reduce the highway repair backlog and slow further deterioration. This estimate does not include any external funding that may be received to support the project.

- Asset Maintenance

- A planned programme of works to meet the Council’s building statutory requirements, Health and Safety requirements and planned maintenance works. The figure does not include estimates of external funding from the Department of Education who provide an allocation ringfenced for the Schools Portfolio.

- Fleet

- A rolling project to renew and replace vehicle assets at the optimum time to derive maximum value and usage whilst minimising increased maintenance, repair and running costs. This includes refuse collection vehicles.

- ICT

- The Council maintains a portfolio of websites and systems and regularly reviews its approach to the digital agenda. This project ensures that the ICT infrastructure is resilient, secure and fit for purpose as well as being future proofed.

A brief description of the Council’s key capital investment schemes is as below:

- South Shields Town Centre

- This project includes construction of a new Tyne Coast College campus area, as well as new college buildings, campus accommodation, public realm improvements and restoration of Grade II listed 16 Barrington Street. Consultation indicated strong support for these proposals.

- Rough Sleeping Accommodation Programme

- Accommodation specifically aimed at people sleeping on the street or at risk of becoming homeless with further help and support to gain the skills required to move on to independent living.

- Mortimer Community College Expansion

- Mortimer is a popular, oversubscribed school with pressure on its places. This project will provide additional classrooms, science laboratories and food technology areas to accommodate the increase in pupil numbers.

- Playground Equipment

- This project will replace equipment over the next 5 years. Part of this programme will look to install new accessible playground equipment for users with disabilities to help to accommodate wheelchairs users and other children who have difficulties using the existing play facilities making the playgrounds accessible for all.

- Youth Facility

- This project will deliver a high-quality Youth Zone which will significantly benefit the Borough’s young people offering a wide range of sporting, artistic, cultural, physical and recreational activities for young people as well as educational access to personal development and informal education.

- Children’s Residential and Assessment Centre

- This £3.6m project will deliver a new purpose-built children’s assessment centre and two residential children’s homes in South Tyneside. This will provide additional capacity to ensure more children from South Tyneside are able to be supported within the Borough.

- Holborn Renewable Energy Network

- This project will utilise renewable technologies to create an innovative energy network providing heat and electricity to a number of buildings. The scheme is expected to deliver significant CO2 reductions helping the Council become Carbon Neutral by 2030. The design of the Holborn site will include an Energy Centre and Centre of Excellence for Renewable Energy Technologies when completed. It is estimated the overall project will be completed in Spring 2028 (subject to funding and planning).

- Holborn Riverside Development

- This project will continue the transformation of Holborn Riverside into a vibrant mix of new dwellings and office space. It will see the development of sustainable businesses and residential communities which broaden the South Tyneside offer and builds upon previous investment in the town centre.

- Stronger Shores

- This project is 100% funded through Environment Agency Flood Defence Grant and Aid. The project aims to improve understanding of the costs and benefits of kelp, seagrass and native habitats with regards to coastal erosion, flood risk, climate change, biodiversity management, water quality and wider social benefits.

- IAMP

- In partnership with Sunderland City Council we are continuing to develop a joint strategic employment site, the International Advanced Manufacturing Park (IAMP), north of Nissan and west of the A19. The development is well underway with over 550,000 sq.ft. of bespoke industrial space delivered over 3 units and a further 1 million sq.ft. of development under construction that will become the base for the region’s first gigafactory.